About PolEconFin

PolEconFin is a platform for researchers active in political economy of finance. This initiative seeks to provide a meeting point for theorists and empiricists with shared interests and build a research community with a focus on public policy.

PolEconFin comprises of two related projects:

1. The online platform to support and promote research in political economy of finance

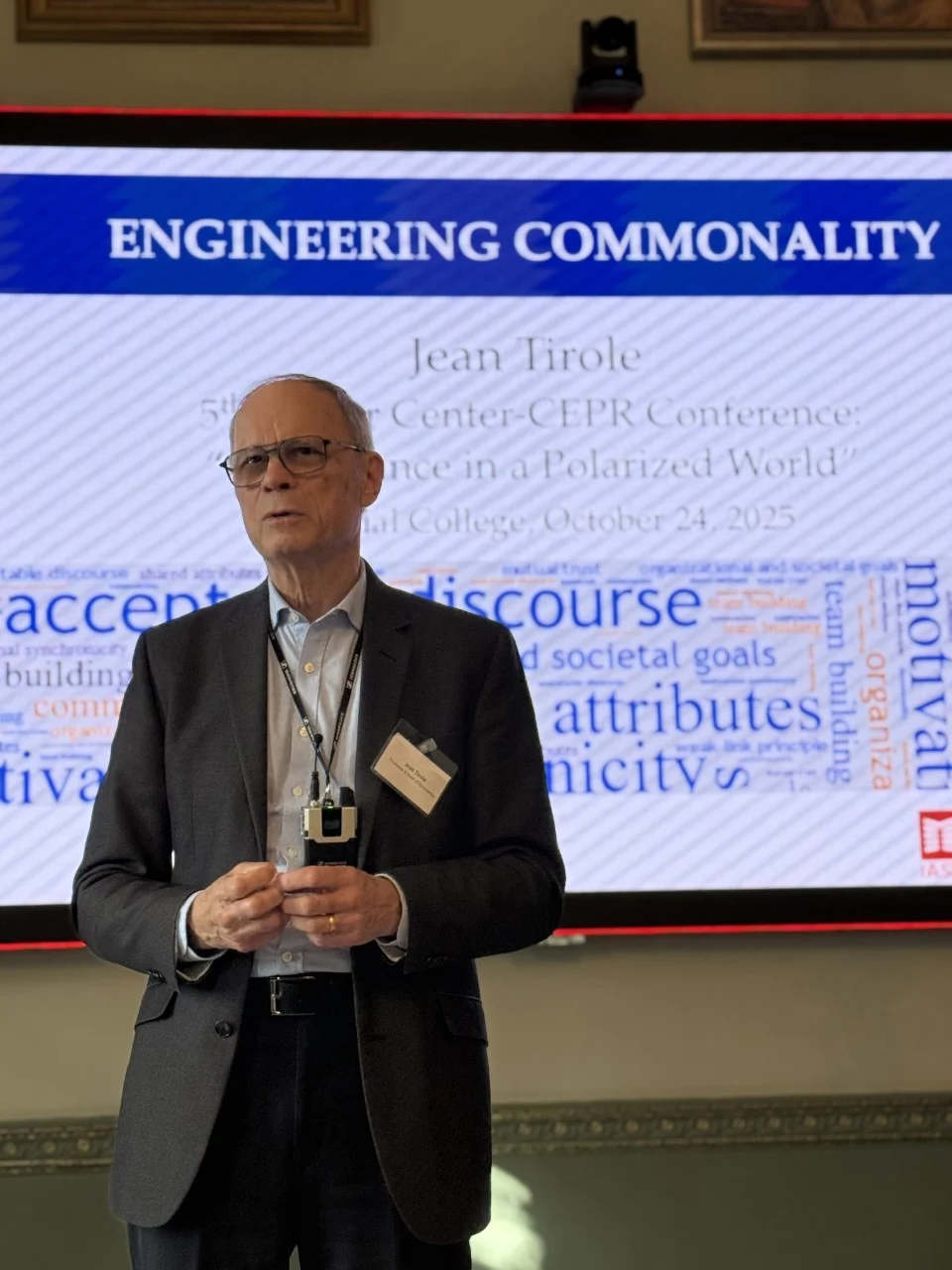

2. The Stigler Center-CEPR Conference Series to stimulate in-person interaction between researchers

Interested in the initiative?

Behind this initiative

PolEconFin comprises of two related projects:

1. The online platform to support and promote research in political economy of finance

2. The CEPR Conference Series to stimulate in-person interaction between researchers